What Makes Fastdot Such a Great Australian WordPress Host?

Fastdot is one of Australia’s premier WordPress hosting providers, offering a high-performance, secure, and feature-rich hosting environment optimized specifically for WordPress websites. With local Australian data centers, advanced security protocols, and a variety of hosting plans, Fastdot provides businesses, bloggers, and developers with a reliable, scalable, and fast hosting experience.

Below, we explore the key advantages of WordPress hosting in general and how Fastdot excels in providing top-tier WordPress hosting in Australia.

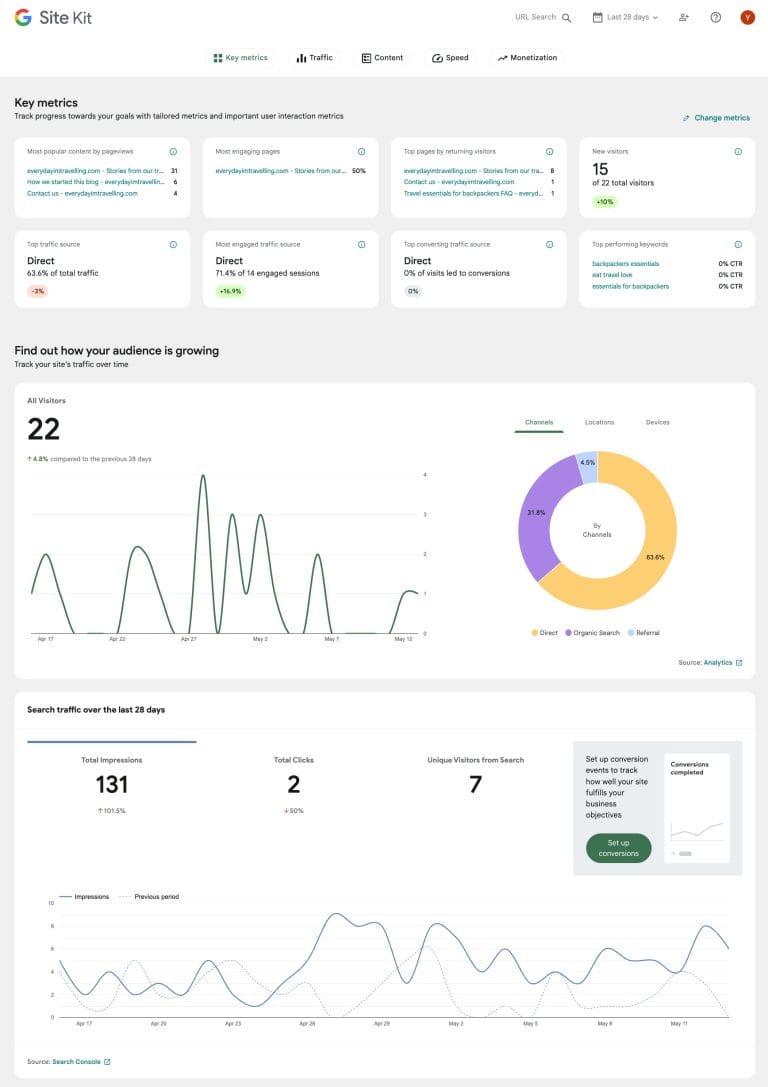

1. Optimized WordPress Performance 🚀

A great WordPress host should provide fast, optimized, and stable hosting. Fastdot ensures this by offering:

✔️ LiteSpeed Web Server: Significantly improves WordPress speed with built-in caching.

✔️ PHP 8+ Support: Ensures better performance and security.

✔️ NVMe SSD Storage: Faster than traditional SSDs for lightning-fast website loading times.

✔️ Australian Data Centers: Reduced latency for visitors in Australia and New Zealand.

✔️ CDN Integration: Uses Cloudflare CDN to distribute content across the globe for a faster page load speed.

✅ Why This Matters: A slow website results in higher bounce rates and lost customers. Fastdot’s infrastructure is built for speed, making WordPress websites load up to 10x faster.

2. Automatic WordPress Management 🛠️

Managing a WordPress website can be technical, but Fastdot simplifies this with:

✔️ One-Click WordPress Installation: Quickly set up WordPress with pre-configured settings.

✔️ Automatic WordPress Core Updates: Keeps your website secure and up to date.

✔️ Automatic Plugin & Theme Updates: Reduces security vulnerabilities.

✔️ WP-CLI Support: Enables advanced users to manage WordPress from the command line.

✔️ cPanel Hosting with WordPress Toolkit: Easily manage multiple WordPress websites.

✅ Why This Matters: Keeping WordPress updated manually is time-consuming. With automatic updates and an easy-to-use control panel, Fastdot ensures effortless WordPress management.

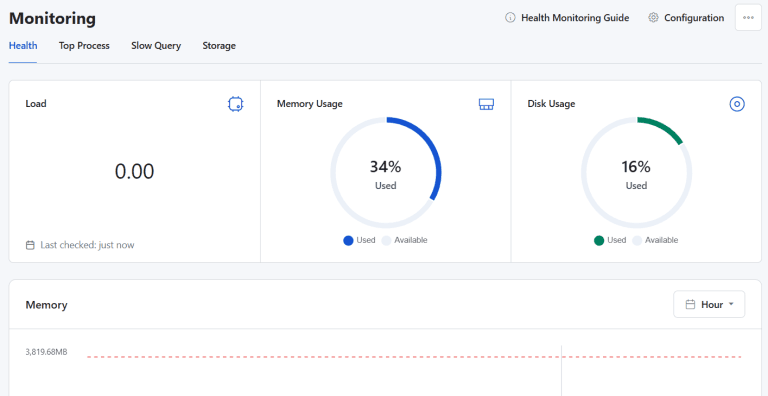

3. Superior Security for WordPress Websites 🔒

Security is critical for WordPress websites. Fastdot provides:

✔️ Free SSL Certificates: Encrypts data and builds trust with visitors.

✔️ DDoS Protection: Blocks attacks before they reach your website.

✔️ Malware Scanning & Removal: Protects against hacks and malicious threats.

✔️ Web Application Firewall (WAF): Blocks brute-force attacks and suspicious traffic.

✔️ Automatic Backups: Provides daily, weekly, or monthly backups.

✅ Why This Matters: Over 30,000 websites get hacked daily. Fastdot prevents security threats before they happen, keeping your WordPress site safe and protected.

4. WooCommerce & E-Commerce Optimization 🛒

For businesses running WooCommerce stores, Fastdot provides:

✔️ Optimized WooCommerce Hosting: Ensures faster load times for online stores.

✔️ Database Performance Boost: MySQL databases are optimized for e-commerce transactions.

✔️ Payment Gateway Support: Seamless integration with Stripe, PayPal, and Afterpay.

✔️ Free Dedicated IP Address: Required for higher security and trust with payment processors.

✅ Why This Matters: Online shoppers expect fast load times and secure transactions. Fastdot provides a stable and scalable environment for WooCommerce websites.

5. Local Australian Hosting & Customer Support 🇦🇺

One of Fastdot’s biggest advantages is its local presence in Australia. This provides:

✔️ Australian-Based Data Centers: Faster speeds for Australian visitors.

✔️ Local Customer Support: Get help from WordPress experts based in Australia.

✔️ 99.9% Uptime Guarantee: Ensures your website stays online without interruptions.

✔️ No Overseas Call Centers: Speak with knowledgeable, local support agents.

✅ Why This Matters: Hosting your website in Australia improves SEO rankings and page load speeds for local users. Plus, local support means faster problem resolution.

6. Affordable & Flexible Hosting Plans 💰

Fastdot offers affordable pricing plans that cater to different needs:

✔️ Basic Plan – Ideal for small websites and blogs.

✔️ Start Up Plan – Suitable for growing businesses.

✔️ Business Plan – Perfect for high-traffic sites & e-commerce.

✔️ Enterprise Plan – Best for large-scale websites with advanced requirements.

✅ Why This Matters: Not every business has the same hosting needs. Fastdot’s scalable pricing ensures you only pay for what you need.

7. Easy WordPress Migration & Staging Sites 🔄

Switching to Fastdot is hassle-free with:

✔️ Free WordPress Migration: Move your website from another host without downtime.

✔️ Staging Environment: Test changes before going live.

✅ Why This Matters: Many hosts charge for migration services. Fastdot moves your site for free.

8. Environmentally Friendly Hosting 🌿

Fastdot invests in green energy-powered data centers, ensuring eco-friendly hosting.

✅ Why This Matters: Businesses focused on sustainability can reduce their carbon footprint with Fastdot’s green hosting infrastructure.

Final Thoughts: Why Choose Fastdot for WordPress Hosting?

✅ Fastdot vs. Other WordPress Hosts

| Feature | Fastdot | Overseas Hosts |

|---|---|---|

| Australian Servers | ✅ Yes | ❌ No |

| LiteSpeed Web Server | ✅ Yes | ❌ No |

| Local Australian Support | ✅ Yes | ❌ No |

| Free WordPress Migration | ✅ Yes | ❌ No |

| WooCommerce Optimization | ✅ Yes | ✅ Some |

| Affordable Pricing | ✅ Yes | ✅ Some |

🌟 Fastdot Stands Out As One of Australia’s Best WordPress Hosts

✔️ Blazing Fast Speeds with NVMe SSDs & LiteSpeed

✔️ Automatic WordPress & WooCommerce Optimization

✔️ Enterprise-Grade Security & Daily Backups

✔️ Australian-Based Hosting & Local Support

✔️ Scalable Plans for Personal & Business Use

✔️ WooCommerce-Ready for E-Commerce Businesses

✔️ Hassle-Free WordPress Migration

If you’re looking for a reliable, secure, and high-performance Australian WordPress hosting provider, Fastdot is one of the best choices available.